You may not realize it, but the financial industry is currently undergoing one of its biggest shifts in recent memory. Just a little over a decade ago, over 50 percent of our purchases were still conducted using cash. Today, that number is below 20 percent.

This is, in large part, driven by the advancements of the FinTech industry. Trust in traditional financial institutions was at an all-time low after the financial crisis of 2008. This paved the way for a new generation of businesses, which put technology at the epicenter of their operations.

In 2019, a study by Ernst & Young revealed that more 64 percent of the world’s population now actively uses some sort of FinTech service. This represents a fourfold increase from 2015, when adoption was at 16 percent.

FinTech businesses are here to stay – and their significance is only increasing. This article will therefore take a closer look at what FinTech actually means, how it came to be, what companies are dominating the space, and its pros and cons.

What is FinTech?

FinTech stands for financial technology and describes new inventions aimed at improving the delivery and usage of financial services. In almost all cases, FinTech solutions are provided through the development of algorithms, cloud computing, and software.

FinTech solutions can be aimed at both private consumers (e.g. in the form of so-called neobanks) or established (financial) businesses, ranging from banks over insurances up to regular businesses like cafes or clothing stores.

Whether it’s paying your friend through Venmo or getting your insurance with Lemonade – FinTech companies have become an integral part of our daily lives. Furthermore, an increasing amount of traditional financial providers have decided to partner up with newly established technology solutions.

Over the past years, the FinTech industry has seen tremendous growth across many sectors. A report by Adroit Market Research projects the global FinTech market to hit $460 billion by 2025.

In its early days, modern-day FinTech companies were focused on improving the work and processes of financial institutions. Potential use cases have drastically expanded over the past few years, mainly driven by the wide adoption of smartphones as well as advancements in computing power and networking infrastructure.

A Short History Of FinTech

The term FinTech can be traced back to the early 1990s. It originated from a project at Citigroup named “Financial Service Technology Consortium”, which was aimed at facilitating the company’s collaboration on technological efforts.

Nevertheless, the usage of technology to deliver financial services has been going on for much longer. A paper by Arneris, Barberis, and Ross devised the evolution of FinTech into three distinctive eras, which we are going to cover in the following section.

FinTech 1.0 (1886 – 1967): First Baby Steps

According to Arneris and gang, the adoption of financial technology has been around since 1886. The creation of the telegraph as well as advancements in transportations (railroads and steamships in particular) helped transferring financial information across state borders.

The first electronic breakthrough came with the invention of Fedwire in 1918, a system created by the Federal Reserve Bank (FED) to move funds electronically. The invention was able to connect all 12 Reserve Banks across the nation through Morse code communication.

With the introduction of Fedwire, banks were able to settle fund transfers and outstanding payments in real-time. Prior to its introduction, settlement of interbank payments was often conducted through the physical delivery of cash or gold.

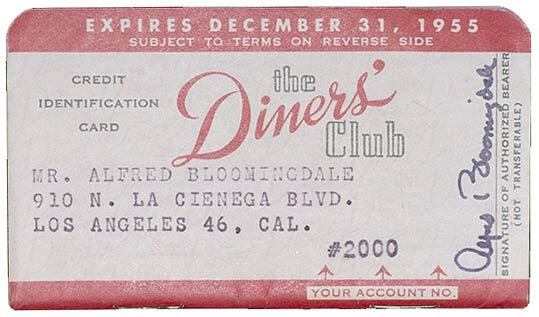

Three decades later, the first-ever credit card was introduced by the Diners Club. One of the club’s customers, Frank McNamara, forgot his wallet while attending a dinner and had to call his wife to settle the bill.

A couple of months later, McNamara and his partner, Ralph Schneider, returned to the club with a small cardboard card and a suggestion that resulted in the Diners Club Card. Club customers were able to make purchases on credit while settling their bills at the end of the month. In 1958, American Express followed suit with the introduction of the first bank-led credit card.

Continued innovation in the computing and telecommunications space provided the necessary platform for further technological enhancements. For instance, the Xerox Cooperation introduced the first fax machine in 1964 under the name of Long Distance Xerography (LDX).

FinTech 2.0 (1967-2008): Building The Modern Day Foundations

By 1967, financial services started moving from a pure analog to a more digitalized industry. That very same year, UK-based bank Barclays installed the first-ever automated teller machine (ATM) at its Enfield Town branch in North London.

In 1971, the world’s first electronic stock market was established. The National Association of Securities Dealers Automated Quotations, or simply NASDAQ, became one of the major catalysts in promoting the buying and selling of stocks.

It helped lowering the bid-ask spread, effectively reducing the difference between the bid and ask price of a stock (which helped accelerate trading). Furthermore, the NASDAQ helped modernize the IPO process by simplifying and speeding up the process for a company to go public.

The early 1980s saw the first attempts of establishing online banking as we know it today. In 1983, customers of Nottingham Building Society (NBS) were the first ever to get access to their bank accounts without being physically present in a store. Called Homelink, the project allowed customers to connect via a television set and their telephone to send transfers and pay bills. Unfortunately, the project was abandoned in the very same year.

Meanwhile, many established banks started replacing their existing internal operations and paper-based tools with computers. For instance, Michael Bloomberg started Innovation Market Solutions (IMS) in 1981 and developed the so-called Bloomberg Terminals, which are still in regular usage by the finance world to this date.

With the creation and emergence of the Internet in the early 1990s, FinTech finally became a worldwide phenomenon. Wells Fargo, in 1995, became the first bank to offer customers an online bank cheque account.

In the coming years, E-commerce paved the way for people to become more comfortable with paying for their goods online. And while many companies did not survive the burst of the Dot-com bubble in the late 1990s, some winners still emerged. These include the likes of Amazon, eBay, or PayPal.

The new century saw further developments in both the consumer as well as business space. New forms of financing and investing, such as P2P lending or crowdfunding platforms (e.g. Kickstarter) emerged, giving consumers and business owners a greater variety to source funds.

Furthermore, the first direct banks that didn’t possess any physical branches started to arise. Examples include well-known brands such as ING Direct, HSBC Direct, or Germany-based DKB.

The democratization and opening of banking is one of the main contributors to lifting more and more individuals from being unbanked. According to a report published by The World Bank, a total of 1.7 billion adults across the globe still remain without a bank account.

FinTech 3.0 (2008-Current): Democratization Of Financial Services

The Global Financial Crisis in 2008 further accelerated the adoption of new technologies. Trust into established financial institutions shrank exponentially, paving the way for the era of FinTech 3.0.

That receding trust led to the infamous creation of Bitcoin back in 2009. A paper named Bitcoin – A Peer to Peer Electronic Cash System was shared on a discussion board about cryptography. It was published by Satoshi Nakamoto, whose real identity remains unknown to this date. Many believe Nakamoto is actually not a person, but a group of people responsible for creating Bitcoin.

Many other cryptocurrencies followed in the years after. Today, the global market for cryptocurrencies is valued at over $1 billion.

Meanwhile, the global adoption of smartphones as well as the creation of 3G/4G technology led to an influx of innovation in the mobile space. For instance, in 2011, Google (through Google Wallet) became the first company allowing users to tap and pay with their phones using Near-Field Communication (NFC) chips in their mobile devices.

Today, FinTech solutions are embedded into almost all aspects of our life – whether it’s paying your Uber ride or DoorDash delivery (both platforms are powered by payment giant Stripe), creating a bank account within a matter of clicks and minutes (through challenger banks like Chime), or investing you’re your hard-earned dollars on Robinhood.

The EY FinTech Adoption Index states that 96 percent of today’s consumers are aware of at least one money transfer and payment FinTech service. Furthermore, over ¾ of all global consumers are actually using at least one FinTech service themselves.

Types & Examples Of FinTech Companies

On a broader level, FinTech companies fall into two distinct categories, being either focused on consumers or other businesses.

According to Crunchbase, FinTech companies have raised a combined $158 billion in over 10,000 rounds of funding.

It’s needless to say that FinTech companies are not only on the rise, but here to stay. They are taking a more important role in many financial aspects of our lives and as such span over many different categories.

Digital Banking

Digital banks (also referred to as neobanks or challenger banks) are direct banks that exclusively operate online and don’t rely on physical branch networks. Instead, they are mostly made available through mobile applications.

Digital banks oftentimes offer the same type of functionality compared to their traditional counterparts. Common offerings include:

- Checking and savings accounts

- Money transfers

- Budgeting and automated savings

In some instances, neobanks work together with established banks to offer other services such as loans or investment opportunities.

Most digital banks do not possess the necessary banking license that allows them to ensure customer deposits or extending credit lines. Therefore, they partner up with established banks that take on that risk.

From a customer’s perspective, the digital bank might amount to nothing more than an app interface that allows one to manage their money.

Because neobanks are often much nimbler with regards to their IT infrastructure, they can sign up customers at a much faster rate – removing the need for necessary paperwork (and instead relying on quick video authentication).

Well-funded examples in the digital banking space include the likes of N26, Revolut, Monzo, and many others.

Research & Insights

This sector of the FinTech industry is all about services that help other firms to investigate and analyze financial data about companies and markets.

Typical customers include mutual funds, banks, security firms, and any other companies that offer financial services.

These companies either provide research services or offer a product that eases the research process (i.e. through databases or APIs).

Examples include AlphaSense, Stocktagon, Seeking Alpha, xignite, and many others.

Banking Infrastructure

Banks across the globe have a combined market cap of $7.6 trillion. And almost all these banks have a need to modernize processes as well as obeying to changes in regulations.

Over 75 percent of a bank’s IT budget is spent on maintaining existing systems. It therefore becomes hard for banks to innovate from within. The solution: investing and spending money on externally provided tools powered by FinTech startups.

The advantage of utilizing third-party services is that they are usually easy and fast to deploy. Furthermore, since many of these tools are offered as monthly charged subscriptions that can be canceled at any time, budgeting for them becomes a lot less complicated.

Example companies include:

- Symphony: An instant messaging platform (similar to Slack) aimed at financial firms. Users can hold meetings through audio and video, share and save files, third-party app integration, and many others.

- nCino: The nCino platform is a cloud-based software developed for banks. It entails customer onboarding, CRM tools, loan origination, credit analysis, and reporting capabilities.

- Kyriba: A capital management system that offers tools such as treasury management, payment gateways, data collection systems, and many more.

Investing

For over 200 years, stockbrokers charged retail investors with a fixed-rate commission for every trade made. As recently as the 1970s, a single trade could be in the hundreds of dollars.

Even after 1975, when the SEC put laws in place to prohibit the charge of excessive rates, buying stocks would still cost up to $75. By the 1990s, fees were still around the $20 mark.

Around the same time, the first electronic trading platforms were created, sparking a worldwide phenomenon and birthing self-proclaimed traders everywhere you looked. One of the companies leading the charge was Palo Alto based E-Trade, which Morgan Stanley eventually acquired in a $13 billion stock deal.

But even by 2014, trades were costing around $5 to $10, something that led Vladimir Tenev and Baiju Bhatt to create Robinhood – the world’s first commission-free trading platform.

Over one million people signed up to the company’s unreleased beta version in 2014. Today, the company counts over 13 million users and sparked a trend across competing brokerage firms to eliminate commissions as well.

In case you wonder: Robinhood (and any other modern-day brokerage for that matter) makes money through the upselling of premium subscription services or interest fees.

Institutional Investing

Institutional investors are companies that invest money on behalf of others. Traditional examples include pension funds, insurance firms, hedge funds, commercial banks, or mutual funds.

Between 70 percent to 85 percent of the ten largest U.S. companies is owned by institutional investors. They furthermore own 80 percent of the S&P 500 index, equal to $18 trillion. Some investments are so big that they can even move market sentiment.

Naturally, these investors oftentimes represent large organizations comprised of thousands of employees.

The FinTech companies in this space help to ease the investment decision process by providing tools and data.

Example companies in the space include Addepar, Dataminr, Trumid, and many others.

Blockchain & Cryptocurrency

The crypto space has made huge strides from its early days. The bitcoin craze of 2017 was quickly followed by countless hacks, ICO scams, and the public’s consensus that cryptocurrencies and the blockchain, its underlying database, would never be more than a hopeful thought.

A lot has happened ever since. More and more startups have emerged and are now commanding a significant share of the Fintech industry. 6 of the 50 companies listed in the Forbes FinTech 50 list can be attributed to this space. Examples include:

- Coinbase: A marketplace for trading some of the world’s most prominent cryptocurrencies. The company even launched its own credit card, which users can load up with cryptos and purchase items.

- Ripple: Ripple encompasses both its own cryptocurrency (called XRP) and a digital payments network, which customers can use to transfer money between each other. Ripple’s consensus mechanism (i.e. the way it validates transactions) is based on a group of servers, which is similar to the SWIFT system for international money and security transfers. Its main advantage compared to Bitcoin transactions (which are based on the blockchain) is the speed of verification and significantly lower energy consumption.

- Axoni: The company is a provider of distributed ledger technology for financial institutions and capital markets. Their technology allows these institutions to conduct various financial transactions based on the blockchain technology.

… and many more. In 2019, the cryptocurrency market alone hit a valuation of $1.03 billion and is expected to grow to $1.4 billion by 2024. During that same time span, the number of cryptocurrency businesses is expected to reach 20,000.

(International) Money Transfers

Transferring money, especially to people living abroad, can be an extremely cumbersome undergoing. Not only are there substantial fees involved, but the process itself tends to be quite confusing and complicated.

For the longest time, people relied on providers with physical branches, including the likes of Western Union or Moneygram.

Ever since the turn of the century, various online businesses have sprung up to make the process of sending and receiving money a lot easier.

That trend was pioneered by PayPal, which was sold to eBay in 2002 for a whopping $1.5 billion. In recent years, startups like TransferWise or Payoneer have taken this to even more efficient levels. Even the digital banks like Revolut now allow to transfer money to foreign accounts.

In almost all cases, the business model is based on charging consumers a percentage fee of the sum that is transferred. The main differentiator between the established money transfer service is the speed of cash delivery as well as the lower fees charged.

Crowdfunding

Crowdfunding is the process of raising smaller chunks of money from a large group of individuals with the aim of financing a product or project. Crowdfunding projects typically occur over the internet.

There are many different types of crowdfunding available. Examples include:

- Early access crowdfunding: customers pay to gain access to the early version of a product, normally at a cheaper rate than the projected price. Oftentimes, fund seekers set specific funding goals to be able to develop the product or service in the first place.

- Profit or revenue sharing: businesses will share future revenues and/or profits in return for funding in the present.

- Donation-based crowdfunding: People donate money to a project without any equity, interest, or product in return.

Individuals and businesses have raised over $40 billion in transaction value in 2017 alone. In 2016, over 2,000 crowdfunding platforms were raising money for various products and causes around the world.

Nevertheless, individuals must be cautious when using crowdfunding as an investment vehicle. Returns on investment are by no means guaranteed. In some cases, investors might even be subject to fraud. Lastly, the crowdfunding platform itself might go out of business, using your investments as securities.

Prominent examples in the crowdfunding space include Kickstarter, GoFundMe, Patreon, Indiegogo, and many more.

The business model of Crowdfunding platforms is centered around charging a percentage fee of the overall funding raised.

Personal Finance

Personal finance is defined as the process of budgeting, saving, or investing monetary resources to accumulate personal wealth. It entails aspects such as mortgages, retirement plans, taxation, banking, or investments.

The activities a person undergoes can vary greatly depending on their level of income, past savings history, expenses, future financial goals, or potentially inherited resources.

As such, the amount and types of personal finance FinTech companies are as widespread as the activities that an individual can undergo.

Just to name a few examples:

- Credit Karma: Founded in 2007, the company provides free credit scores and credit reports from national credit bureaus, a daily credit monitoring tool, tax filing options, a credit card, loans, and many other financial products.

- Nova Credit: The startup sources credit report information from eight countries to create a so-called Credit Passport. It enables immigrants to the U.S. to qualify for loans, credit cards, or apartment rentals based on their home-country’s credit record.

- Propel: Headquartered in New York, the company’s mobile app enables food stamp recipients to check their balances without having to call an 800-number. Furthermore, users can search for job postings, reach out to social services, or electronically clip store coupons for retrieval.

- Tala: The startup gives developing country citizens the chance to borrow anywhere between $10 to $500 without any significant history of borrowing money. Their smartphone data is used to assess risk. For instance, applications that regularly text their parents or pay bills on time are more likely to receive a loan.

The usage of technology within personal finance is as diverse and widespread as the customer base it attracts and companies it helps to create.

Payments Backend

With the rise of the Internet and e-commerce came the need for mobile and web-based startups to handle large amounts of transactions on their platforms.

Payment processors are an in-between service, handling the entered information supplied during the checkout process. Furthermore, these processors take care of payment authorization as well as the fulfillment of the payment.

The process looks roughly like this:

- The customer buys an item or a service using a credit or debit card

- The payment information is transmitted through a payment gateway, which stores and safely encrypts the data to keep it private, and then sends it to the processor of the payment

- The payments processor issues a request to the customer’s bank to check if they possess a sufficient balance

- The bank responds with either an approval or denial

- The payments process then sends that answer back to the platform that made the sale, effectively accepting or denying the purchase

The above process can take anywhere between one to five seconds, depending on the parties involved. And processing payments is certainly extremely lucrative. The global market for payment processing is projected to hit $62.3 billion by 2024.

Furthermore, according to Venture Scanner, payments processing startups are among the highest to achieve an exit (either through a sale or going public).

Lastly, some of the world’s most well-funded startups belong in this category. Examples include the previously mentioned Stripe, Adyen, Sweden-based Klarna, or BlueSnap.

The business model, in many cases, is predicated on charging a percentage of the transaction volume. In recent years, these companies went on to use their cash to extend into other services such as loans, (business) bank accounts, or API gateways.

Pros & Cons Of The FinTech Model

As previously mentioned, FinTech companies can come in many shapes. Therefore, the advantages and disadvantages of the FinTech model can be far-reaching for both the company itself as well as the customer buying into it.

Nevertheless, there is a set of benefits and risks that all of them share. These will be mentioned below.

Advantages Of The FinTech Model

Financially lucrative. The financial industry is one of the biggest in the world, and as such, poses many opportunities to generate significant amounts of revenue. Startups in the space are among the best-funded and highest valued.

Slow-moving incumbents. Many existing players (especially traditional banks) are built on outdated legacy systems. This makes it extremely difficult to respond to fast-changing consumer trends. Some of the newly established neobanks have used this to their advantage and started snatching away customers from established banks. Other incumbents have responded by partnering up with these challenger banks, providing the underlying banking license and regulatory expertise.

Loyal customer base. The average U.S. adult has uses their bank account for 16 years. Customers trust their banks by keeping their finances safe, borrowing money for life-changing purchases like a house, or how to best invest existing funds. While acquiring a customer isn’t cheap (banks, for instance, spend billions every year for various marketing activities), they tend to be extremely loyal over the course of their membership.

Disadvantages Of The FinTech Model

Highly regulated industry. There are over 20 governmental institutions in the US alone that oversee a bank’s compliance with existing regulations. Furthermore, existing laws as well as accounting standards are changed on a continuous basis. Complying with all of these regulations can therefore be extremely complex.

Cost of operation. With a complex regulatory body comes the need for hiring skilled labor that can navigate this environment. Furthermore, given how lucrative the financial space is, FinTech businesses often must invest heavily in acquiring customers. Take, for instance, Brex, which offers a credit card for startups. The company had spent millions on billboards across popular tech cities such as San Francisco or New York.