Executive Summary:

Klarna is a financial technology platform that facilitates payments on behalf of other companies. It partners up with other businesses to offer their customers the option to pay for the products in multiple installments.

Klarna makes money via merchant fees, late payment fees, interest on consumer loans, interchange fee, interest on cash, licensing fees, advertising, and referral fees.

Founded by two Swedish business students in 2005, the company has proven to be a great success. Klarna has raised a total of $4.5 billion in venture funding.

What Is Klarna?

Klarna is a payment service provider, which allows consumers to try out products before they pay for them. Klarna partners up with retailers to handle the payment process on their behalf. This is referred to as ‘Buy Now, Pay Later’ (BNPL).

Consumers have the option to choose from a set of different payment options, ranging from paying directly (and up to 30 days later) to multiple interest-free rates. Payments can be made online (e.g. through PayPal), via bank transfer, or the Klarna mobile app.

With bigger purchases, Klarna also allows you to finance with a maximum run rate of 36 months and multiple payment installments.

Consequently, Klarna does not charge the consumer but the retail stores it works with. There are no interest, fees, or late charges. Payment approval for consumers depends on a soft credit check (without affecting your credit score), your credit history, age, salary, and other factors.

So why would an online store give away shares of their revenue to have payments processed? Because, as the company states, having Klarna as your payment solutions leads to a 44% increase in orders (i.e. conversion rate) and a 68% increase in order volume.

Another big advantage for the merchant is the fact that whether or not the customer ends up paying, Klarna already transfers the money for the transaction.

Lastly, Klarna also offers its merchants a set of tools to increase sales. These include:

- Business insights: a dashboard tool to analyze metrics such as the number of orders, weekly sales, or conversion rates

- On-site messaging: a chatting tool which allows merchants to answer their customer’s most pressing questions

The company facilitates payments for brands like Etsy, ASOS, H&M, Calvin Klein, along with 450,000 other merchants.

A Short History Of Klarna

Where do revolutionary startups normally originate? For most of them, the answer is probably not Burger King. Then again: Klarna’s founders are far from the ordinary either.

Sebastian Siemiatkowski, Klarna’s acting CEO, and Niklas Adalberth met in their teenage years when the pair was flipping burgers and serving hungry guests at Burger King. Even back then, they always used to discuss startup ideas.

Their thirst for entrepreneurship led them to study economics at Sweden’s prestigious Stockholm School of Economics. As fortune would have it, that is where they’d later meet Victor Jacobsson, their third co-founder.

Before embarking on their master’s degrees, Sebastian and Niklas decided to take a trip around the world – without taking a plane. That would mean long stints on ships and buses. The trip’s purpose was to not only widen their horizon but eventually discover a business idea to start.

Ironically , that is not how the idea for Klarna came to be. After missing their boat in Australia, the pair had to decide whether they wanted to fly back home or postpone their trip – and eventually ended up choosing the latter.

When they got back to Sweden, it was too late for Sebastian to enroll in his master’s degree, which due to the ripple effects of the dotcom crisis (and thus lack of opportunities), saw him doing telesales.

He ended up working at a debt collection agency whose primary purpose was to collect outstanding payments on behalf of e-commerce stores. Back in the early days of the internet, users frequently did not pay their invoices, leaving online stores with loss of credit.

The store owners told Sebastian that if his employer could bear the risk, they will let them handle the transactions. Sebastian, the entrepreneur he is, took that idea to his superior, but he was simply not interested.

He eventually was able to pursue his master’s at the Stockholm School of Economics, together with Niklas and Victor Jacobsson. After telling the guys about his previous experience at work (and the subsequent rejection), they curtly decided to pursue the idea.

A few weeks later, the team presented the first concept of Klarna at an innovator’s pitch – and received overwhelmingly bad feedback, stating that the idea is never going to work out.

Luckily enough, at a networking event, they came across Jane Walerud, one of Sweden’s most successful angel investors. Three weeks later, she handed the guys 60,000€ in seed funding (for a 10% stake) and 5 software developers in exchange for another 37% of the company.

Six months later, and with only half of its 60k funding used, the company was already being profitable. Klarna continued to grow steadily over the next few years. In 2010, Klarna became the first-ever European tech startup that Sequoia put money into (leading its $155 million round).

Whenever competition arose, the FinTech simply decided to acquire it. In 2013, for instance, Klarna acquired Germany-based Sofort AG for $150 million. Klarna has acquired 6 more companies ever since.

In 2015, Klarna finally decided to enter the big leagues by expanding into the United States. The company initially spent $100 million for its U.S. expansion, which became one of its major growth drivers.

In the states, Klarna faces stiff competition from the likes of Affirm and PayPal (as well as traditional credit card companies). So far, the company has amassed a U.S. customer base of 7.85 million.

Another big push became the firm’s move into physical retail. In 2016, Klarna announced its first brick and mortar partnership. Today, the FinTech partners up with the likes of Sephora or Macy’s to provide customers with additional payment options during checkout.

A year later, Klarna received a banking license, which would allow them to expand beyond payment processing. So far, Klarna has stirred away from launching consumer banking products, mainly due to intense competition in the space (including the likes of Chime, Revolut, N26, and more).

Klarna also had its fair share of troubling experiences of the years, despite being portrayed as one of Europe’s model startups. In 2012, 2 company executives (of which one included co-founder and then co-CEO Niklas Adalberth) have been arrested for alleged molestation (involving a 19-year-old woman) in a New York hotel.

The company also made some subpar business decisions. In 2017, it launched a peer-to-peer payments app called Wavy to go against the likes of Venmo. The app was shut down just 2 years later.

Additionally, Klarna has faced numerous instances of criticism from consumer organizations and debt charities, stating that the company promotes poor financial decision-making, resulting in massive liabilities.

Ironically enough, Klarna will defer to a debt collection agency should consumers be unable or unwilling to pay.

In January 2021, the U.K. government announced that ‘Buy Now, Pay Later’ companies would be subject to stricter regulations in the future. In the future, these firms will be asked to undertake more comprehensive background and credibility checks.

To that extent, Klarna has been focused to shift its direction towards becoming a financial super app. It, for instance, launched a bank account for its German customers in February 2021, putting it in direct competition with the likes of N26.

This will allow Klarna to better assess a user’s credit score and probability of default by getting an overview of available funds, financial statements, salary, and more.

Competition in the BNPL continued to heat up throughout coming months. The coronavirus pandemic, in particular, greatly accelerated Klarna’s growth. One of its biggest competitors, Afterpay, was scooped up by Square (now BLOK) for a whopping $29 billion in August.

Klarna, on its end, continued to raise astounding amounts of money. In June, for example, it managed to raise close to $640 million in funding at a valuation of over $45 billion.

It used portions of that cash to then acquire three different companies, most prominently German digital wallet fintech Stocard for around €110 million, within a matter of weeks.

Over the coming months, Klarna remained focused on expanding into new markets as well as offering new features to its customers. In an effort to fend off U.K. regulators, it introduced an option to pay retailers in full during the checkout process.

Furthermore, it continued to acquire other businesses to expand its reach. Most notably, it acquired the Swedish comparison site Pricerunner for an eye-popping €930 million in October.

Unfortunately, worse times would soon be on the horizon. Due to regulatory pressure, Klarna agreed to begin reporting U.K. customer debts to credit agencies. Moreover, worsening market conditions forced the company to make some significant layoffs.

In May 2022, the firm laid off 10 percent of its workforce (equal to around 700 employees). However, many took offence in how those layoffs were conducted. CEO Sebastian Siemiatkowski delivered the message in a prerecorded video and was later accused of being “tone deaf” after he published their emails online (to help them get re-hired faster).

Klarna’s woes continued when, in July, the firm raised an $800 million round of funding at a valuation of $6.7 billion – down 85 percent from its previous round. To make matters worse, another 100 jobs would be terminated 2 months later.

How Does Klarna Make Money?

Klarna makes money via merchant fees, late payment fees, interest on consumer loans, interchange fee, interest on cash, licensing fees, advertising, and referral fees.

Let’s take a closer look at each of Klarna’s revenue streams in the section below.

Payment Fees

Klarna generates the bulk of its revenue by charging merchants a fixed transaction fee and a variable percentage fee. The fees are dependent upon the payment method the customer chooses as well as the country.

Taking the United States as an example, businesses must pay a $0.30 transaction fee. The variable fee ranges anywhere from 3.29% to 5.99%.

Klarna offers a variety of payment methods, ranging from direct checkouts to loan financing. For its Instant Shopping solution, which allows customers to check out within a matter of a few clicks, Klarna charges its merchants:

- A $30 monthly product fee

- A fixed $0.30 transaction fee

- Variable fees up to 3.29% for onsite and 3.79% for offsite sales, respectively

The Instant Shopping feature is a part of Klarna’s wider payment products, which include online (named Checkout) as well as offline (called In-store) solutions.

The supposedly seamless shopping experience allows merchants to increase their conversion rates, simply by removing friction as well as having Klarna as a trusted payment processor enabled.

For users that don’t want to pay immediately, Klarna offers a variety of financing methods. These include 4 Installments, Financing, and Pay in 30 days.

With 4 Installments, as the name indicates, customers can settle their bill over the course of 4 payments (with 2 weeks in between each payment). Klarna charges merchants a $0.30 fixed fee as well as variable fees up to 5.99%.

Klarna Financing allows customers to spread the cost by paying monthly. Customers will complete a minimum of 3 payments while the payment period can last up to 36 months. Klarna charges merchants $0.30 fixed and 3.29% variable fees.

On top of that, consumers will have to pay interest on the loan, which can range from 0% to 29.99% APR. This gives Klarna an additional stream of income.

Pay in 30 days is aimed at customers who want to try the product before they buy it. This option is mainly aimed at fashion merchants, such as ASOS or TOMS. Payments must be settled within 30 days. Merchants are charged with a $0.30 fixed as well as 5.99% variable fee.

Lastly, Klarna charges late payment fees should the invoice not be settled on time. These late payment fees are charged on a monthly basis and can go as high as $35.

Competitors, such as Quadpay or Sezzle, monetize in a similar way. However, others, such as Splitit, in an effort to differentiate themselves, have decided to abandon late payment fees. That, in turn, vastly increases their risk and thus cost base.

Interchange Fees

As previously stated, Klarna announced its launch of a bank account for the German market in early 2021.

Meanwhile, a physical credit card was unveiled for U.K.- and U.S.-based customers in January 2022.

The product works like any other bank account, allowing people to store their funds, set saving goals, or conduct transfers.

On top of that, Klarna will issue a free debit card in cooperation with payment provider Visa.

Whenever you pay with your debit or credit card, a so-called interchange fee is applied. Interchange fees are paid by the merchant and normally are less than 1 percent. So if you buy something for $100, around $1 of that would go to Visa.

Klarna would then receive a portion of that fee in exchange for promoting the card to its users. The actual percentage share is not publicly disclosed.

The card also offers another advantage in that it enables Klarna to save payment processing costs whenever a user checks out with Klarna’s own card instead of an external one.

Advertising

Klarna counts 150 million active customers while facilitating over 2 million transactions every day.

And those customers are all using the platform for one purpose: shopping. Engagement and purchase intent often represent the holy grail of advertising, which Klarna is perfectively positioned to tap into.

Its is, therefore, not surprising that Klarna has since introduced various advertising options for the merchants it partners with.

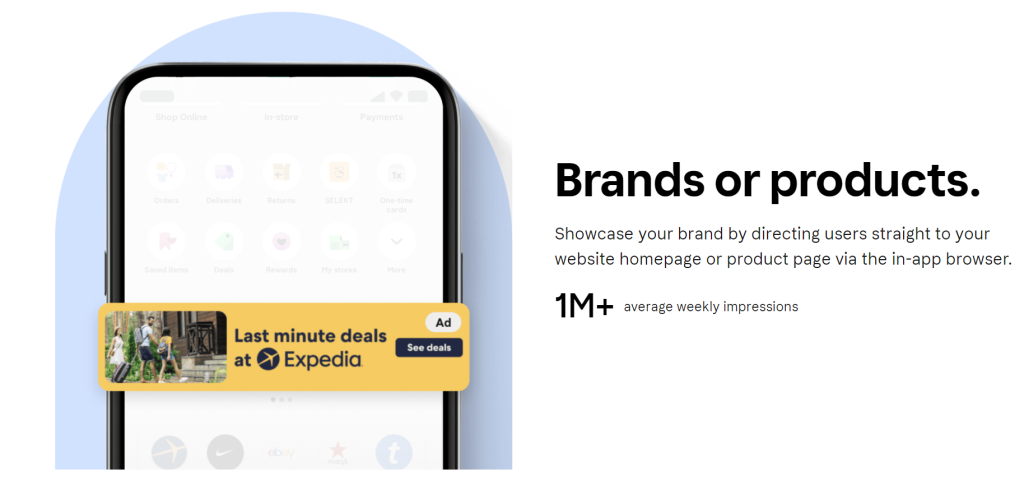

Klarna offers 3 distinct advertising options, namely search, banner ads (see below), and via the emails Klarna sends out.

It is unclear how exactly Klarna monetizes its advertising solutions. In all likeliness, it charges merchant either clicks on the ad (CPC).

One of the biggest advantages of advertising on Klarna is end-to-end trackability. Consumers will check out within the Klarna app, so advertisers exactly know how many clicks have led to actual sales.

Back in October 2022, Klarna extended its advertising platform by enabling brands to partner with influencers who rep their products. The vetted creator platform gives brands access to over 500,000 influencers.

The video content that they create is then displayed directly within Klarna’s shopping app and similar to how content is being served on platforms like TikTok.

Licensing Fees

Klarna offers an open banking solution called Kosma, which allows companies to access the data of more than 15,000 banks via different APIs.

This enables app and web developers to verify a user’s banking data, conduct transfers, categorize spending, understand a customer’s risk profile, and so forth.

Open banking solutions like Plaid have led the initial wave, essentially democratizing access to banking data. FinTech apps like Chime or Revolut have utilized that data to create consumer-facing products used by tens of millions of people.

With regards to Kosma (and almost any other open banking provider), it makes money via licensing fees.

Every time a request is issued to Kosma’s API, a small fee will be charged to the developer’s balance.

This is effectively a volume game since almost every action on the consumer app, whether it’s checking your balance or issuing a transfer, will incur a small fee.

Referral Fees

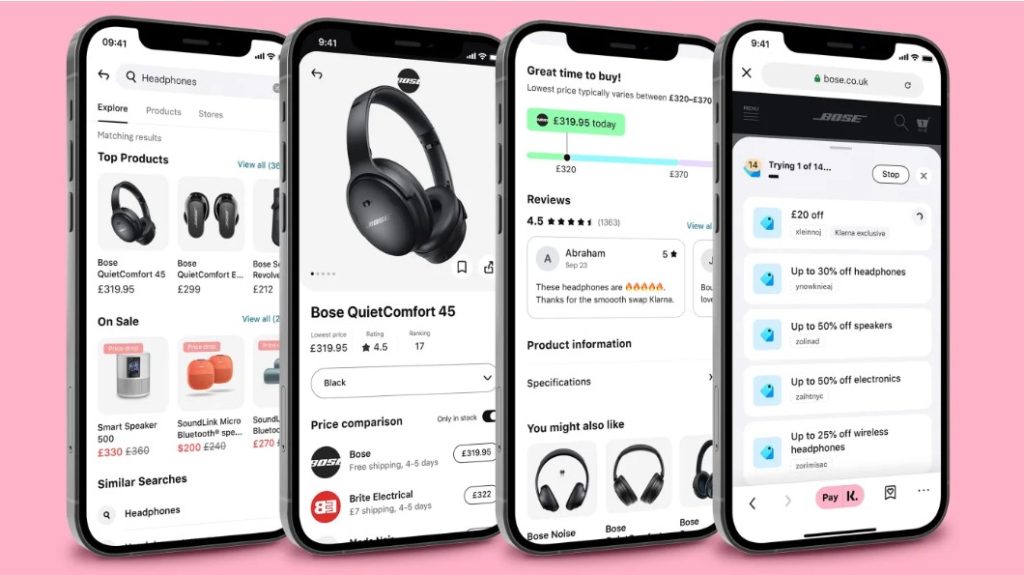

Back in November 2022, Klarna expanded into the world of price comparisons by launching a tool that lists product prices for thousands of retailers.

The product was a result of Klarna’s €930 million acquisition of PriceRunner, which closed in late 2021.

Users can compare prices within Klarna’s dedicated shopping app. Consequently, some of the retailers listed on the comparison list also offer BNPL as a payment option.

Klarna, just like any other affiliate, generates revenue from commissions for every sale it facilitates.

The commission that it receives is dependent on the agreement it has with each merchant as well as the category they’re in.

However, and far more importantly, it extends the shopping ecosystem that’s core to Klarna’s business model strategy, which I’ll now detail.

Interest On Cash

Klarna, just like any normal bank, uses the unused cash residing on its user accounts to generate interest income.

It deposits said cash into interest-bearing bank accounts on which it then generates income.

The Klarna Business Model Explained

The business model of Klarna is centered around becoming a shopping and potentially even financial super app.

While paying for goods in various instalments remains core to Klarna’s offering, it has now expanded into a plethora of ancillary business lines.

The move to create an ecosystem is necessary from both a competitive and regulatory perspective.

Klarna, for the first 10 or so years of its existence, was essentially unchallenged in the BNPL industry. Point in case: Affirm was only founded 7 years after Klarna while Afterpay emerged 9 years later.

This enabled Klarna to vastly expand its merchant base across a variety of key markets like the United States, the United Kingdom, Australia, and large parts of Europe.

At the same time, regulatory pressures and public scrutiny due to increased consumer debts were starting to mount. The heightened attention was amplified during the Covid-19 pandemic, which saw BNPL usage explode.

However, Klarna can only take on so much new consumers without severely increasing downside risk. Additionally, since consumers are banned from using the service when missing a payment, there’s somewhat of a natural ceiling when it comes to Klarna’s total addressable market.

As a result, Klarna needed to vertically expand into other products to maximize the value it can extract from both users and merchant partners. The first step into that direction was the securing of a banking license, which technically enables Klarna to hold customer deposits and even issue loans.

For now, Klarna remains mostly set on the commerce sector, though. Its shopping app is now at the center of its business model strategy, allowing Klarna to cross-sell consumers into a variety of different offerings.

The single biggest advantage of Klarna’s app is that it owns the user experience. Traditionally, it competed against other payment providers, such as PayPal, debit and credit cards, or bank transfers, when a consumer checked out.

Now, Klarna can not only capture that payment but also control what specific offers consumers are directed to. For example, it can nudge them towards a special brand deal where the consumers gets a higher discount while Klarna pockets higher payment fees.

Another example of Klarna’s shopping-centered strategy is the introduction of video content. Creators can now work with brands and promote their products through highly-engaging content, which is much likelier to drive conversions.

Acquisitions have also played a key role in advancing Klarna’s shopping ecosystem. As I’ve stated above, the PriceRunner purchase was used to launch Klarna’s price comparison feature, which it can further monetize. And merchants that aren’t yet part of the price comparison tool are now incentivized to join Klarna because they can tap into a much larger pool of buyers.

Stocard, which I profiled here, is yet another example. The purchase ultimately informed Klarna’s loyalty card feature, which enables users to connect all of their existing loyalty cards to the app.

Other ways with which Klarna incentivizes shopping include the firm’s own Visa-branded debit card (where it also makes money through interchange fees) and its reward club where users can earn points for shopping on Klarna.

This is also where the ecosystem / supper app strategy comes into play. The more consumers engage with Klarna’s app, the more the company learns about their shopping behavior.

In turn, that data can be used to recommend more relevant products to them or allow its advertisers to better target users. It is also where Klarna’s open banking solution Kosma may come into play.

Kosma already partners with a variety of different consumer-facing FinTech apps such as Peaks or Friday Finance. Therefore, Klarna gets access to the usage data for each of those apps from which it can approximate business performance metrics.

It would not be unfathomable to assume that Klarna may end up acquiring one of its FinTech partners to offer banking or investment solutions to consumers, especially considering that the firm already holds a banking license.

With the stock piles of purchasing data Klarna has managed to amass, it could easily begin offering products such as consumer loans for its most reliable borrowers.

For now, its BNPL and the extensive merchant base it has built will remain the moat around with which Klarna drives differentiated returns. However, with both interest rates and consumer debt levels rising, it’s likely that Klarna continues to diversify away from BNPL loans towards welcoming shoppers of all kind.

Klarna Funding, Valuation & Revenue

According to Crunchbase, Klarna has raised a total of $4.5 billion across 33 rounds of debt and equity funding.

Notable investors into the company include the likes of Dragoneer Investment Group, DST Global, Silver Lake Partners, BlackRock, General Atlantic, Ant Group, and many more.

Klarna is currently valued at $6.7 billion after it raised $800 million in July 2022. This represented a 85 percent decrease from the $45.6 billion valuation it amassed just a year prior.

For the fiscal year 2021, Klarna generated $1.375 billion in revenue. In the meantime, the company posted a net loss of $709 million.