Executive Summary:

Wealthsimple is a personal finance platform offering a variety of products, including automatic investment portfolios, tax optimization, or (crypto) trading.

Wealthsimple makes money via management fees, currency conversion fees, operations fees, additional services, interest on cash, as well as interchange fees.

Founded in 2014, Wealthsimple has grown to become Canada’s biggest robo-advisor. The company is now valued at CA$ 5 billion.

How Wealthsimple Works

Wealthsimple is a financial technology company that offers a variety of products in the investing and savings category.

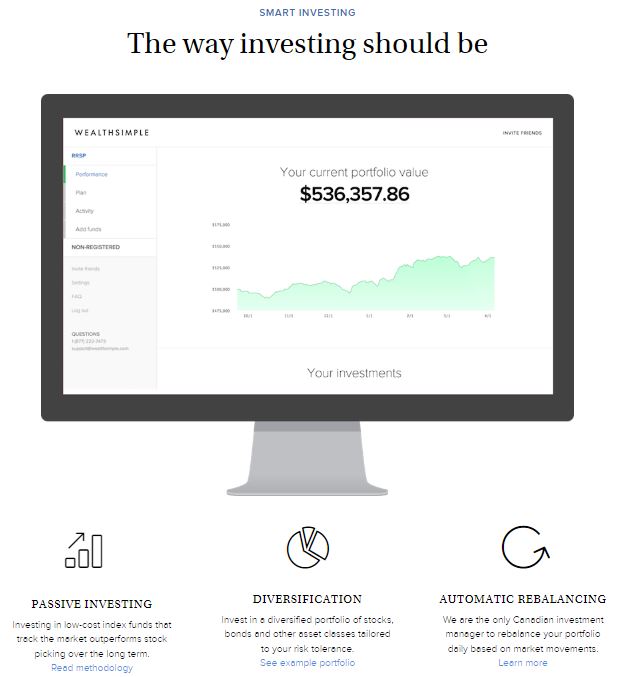

Wealthsimple Invest is a robo-advisor that automatically invests money on the user’s behalf. Users can choose the risk level they’re comfortable with, ranging from high to conservative. The robo-advisor is aided by human experts who can adjust any given portfolio if needed.

Wealthsimple Cash allows users to store, retrieve, and send money to others (much like Square’s Cash App or Venmo). The cash account comes with an associated Visa debit card. Funds are, furthermore, ensured by the CDIC for up to $100,000 (the Invest account is covered by the CIPF).

With Wealthsimple Trade, users can purchase and sell thousands of stocks and ETFs without paying a commission. Additionally, users can also invest in fractional shares or cryptocurrencies. Unlike the Invest account, Trade doesn’t offer any financial advisory.

The company differentiates itself from other platforms by allowing users to invest in socially beneficial stocks and ETFs. For instance, users can put their money into shariah-compliant stocks or invest in ETFs that only include companies adhering to environmental, social, and corporate governance (ESG) criteria.

Lastly, Wealthsimple also offers a tax filing product to both individuals as well as business owners via its Tax feature. Apart from software products, users can also consult with a tax expert hired by the company.

Wealthsimple thereby provides users with a variety of educational material, whether text- or video-based, on how to properly use their products, invest in the capital markets, or get the most out of their tax returns.

Users can access Wealthsimple either by visiting the firm’s website or downloading any of its mobile apps (available on Android and iOS devices).

Detailing The Founding Story of Wealthsimple

Wealthsimple, headquartered in Toronto, Canada, was founded in 2014 by Michael Katchen (CEO), Brett Huneycutt, and Rudy Adler.

CEO Katchen had been exposed to the world of investing from an early age. His father worked as a stockbroker while his older sister was employed in the investment world as well.

At the age of 12, he entered a stock-picking contest together with his dad. They put all of their virtual contest money, $100,000 to be exact, into a company called MGI Software Corp.

During the eight weeks of the content, which took place at the height of the tech bubble in 1999, MGI’s stock soared by more than 260 percent. The pair ultimately won the contest, which led Michael to purchase some actual MGI shares with his pocket money.

Unfortunately, two years later, the tech bubble burst, forcing him to sell his shares at a 90-percent loss. This ultimately served as his first learning experience in the world of responsible and diversified investing.

After graduating from college, Katchen went on to work for McKinsey where he ended up meeting Huneycutt (and through Huneycutt, Rudy Adler.). In 2011, after almost two years at McKinsey, Katchen joined the startup that Huneycutt and Adler had started.

The duo had just gone through the world-renowned startup accelerator Y Combinator while building 1000Memories, a smartphone app that allowed users to arrange, share, and discover old photos and memories and set up family trees.

After raising $3 million in venture funding from investors like Greylock or SV Angel, 1000Memories was acquired in September 2012 by Ancestry.com. Both Katchen and Huneycutt stayed on at Ancestry for close to two years while Adler pursued other venture ideas.

As a sort of educational exercises, Katchen had built an Excel spreadsheet that would show his fellow co-founders how to invest their newly found riches properly. They would then go on to share that spreadsheet with their friends who would all return with the same feedback: we are too lazy and need someone else to do the investing for us.

They even built a web app that would send notifications on what ETFs and stocks to buy. Yet again, people wanted more passiveness and less complexity. Around the same time, robo-advisors like Wealthfront began making news down south in the United States.

Meanwhile, back home in Canada (Katchen moved back from San Francisco to Toronto in 2013), existing providers were often charging exorbitant fees because most of their financial advisory was still conducted by humans.

Around the beginning of 2014, Kitchen and his fellow 1000Memories co-founders decided to bring the first robo-advisor to Canada and thereby began working on Wealthsimple.

They then managed to convince Joe Canavan, a pioneer during the 1990s mutual fund boom, to become the startup’s first backer. Once Canavan was officially on board, the 13 other backers of the firm’s seed round jumped on board within a matter of weeks. Those seed investors poured a total of CA$1.9 million into that initial round.

In September 2014, Wealthsimple launched the first version of its product, a technology-driven investment manager that invested in low-cost index funds across 10 asset classes, to users in British Columbia and Ontario. By May 2015, the platform was available across Canada.

However, just a month prior, the company made waves by raising a CA$30 million Series A investment from financial giant Power Financial Corp. While the two companies initially met to discuss a potential partnership, Power eventually decided to become a majority backer of Wealthsimple. The investment was part of Power Financial’s strategy to build and invest into a justice league of Canadian FinTech startups, which also included Borrowell and League.

Three months after the funding round, in July, Wealthsimple unveiled its first-ever Android and iOS apps, which tremendously accelerated growth as more and more FinTech startups were building mobile-first products for a digitally savvy millennial generation.

To cap the year off, Wealthsimple also announced its first acquisition. In December 2015, it purchased Canadian automated investment manager ShareOwner for an undisclosed amount.

The deal allowed Wealthsimple to become an end-to-end platform, meaning it would be able to conduct trade execution, portfolio construction, and more all under one operation. At the end of the year, Wealthsimple already counted 10,000 clients and $400 million in assets under management (AUM).

Much of 2016 was spent capitalizing on that initial growth. In May, the company launched Wealthsimple for Advisors, which allowed outside financial advisors to use its technology for their own clients.

In January 2017, right after raising another CA$20 million from Power Financial Corp, Wealthsimple even aired its first-ever Super Bowl ad. A month after, Wealthsimple expanded into the United States, its first foreign market.

Around the same time, two and a half years after launching, Wealthsimple hit the inaugural mark of $1 billion in AUM. Wealthsimple followed this up by launching in the U.K. (September) as well as introducing a high-interest savings account (December).

In 2018 and 2019, the platform continued to add on additional funding (CA$65 million in February 2018 and CA$100 million in May 2019) while further expanding its product line. One of the biggest launches was the introduction of Wealthsimple Trade, a commission-free online brokerage like Robinhood, in March 2019.

The company, furthermore, put its focus towards partnerships as a means of growth. For instance, in January 2019, Wealthsimple partnered up with TurboTax to allow its users to assess their taxes and open an RRSP account all within its platform.

Expanding one’s feature set, either through in-house development or partnerships, is a widely used tactic by many FinTech companies. This enhances the platform’s ability to cross-sell other, potentially more lucrative services.

Take, for instance, Chicago-based M1 Finance. The company began as a simple trading app and now offers a debit card, cashback rewards, loans, high-yield savings accounts, and much more. And because these platforms are aware of a user’s spending habits (and other data points), they can offer tailored products at minimal risk.

The continuous product expansion allowed Wealthsimple to fully take advantage of what was about to come. As a result of the coronavirus pandemic, which saw people being forced to quarantine at home (thus unable to visit local banks) while trying to find avenues to spend their stimulus checks, Wealthsimple grew exponentially.

The firm continued to react to trends, for instance by launching a cryptocurrency trading platform in September 2020. A month later, it raised CA$114 million in financing, valuing its business at CA$1.4 billion and officially putting it in the unicorn club.

Wealthsimple also launched its own Cash app, which much like Zelle, allows its users to send money to each other. It became Canada’s first financial platform to do so. Furthermore, the January 2021 meme stock frenzy catapulted the firm’s iOS app to the top of the Apple Store charts.

As a consequence, Wealthsimple was able to double its AUM from CA$5 billion at the end of 2019 to more than CA$10 billion at the start of 2021. In less than 7 months, after just hitting unicorn status, Wealthsimple raised another round (in May 2021), this time valuing its business at a whopping CA$5 billion.

However, the company also had to take some losses. In March 2021, Wealthsimple announced that it pulled out of the United States to focus on its home market Canada. Its U.S. business was sold to competing platform Betterment for an undisclosed amount.

Similarly, the online broker also its U.K. business for an undisclosed sum in December to Moneyfarm. As a result, it lost around 160,000 customers. Unfortunately, the negative sentiment continued well into 2022.

Wealthsimple, fueled by skyrocketing inflation and economic slowdowns, was forced to lay off 13 percent (~ 159 people) of its staff.

And to make matters even worse, a CA$10 million class-action lawsuit was filed against Wealthsimple (plus FinTech contemporary Shakepay), stating that the two firms misrepresented the true costs of their cryptocurrency services.

Today, more than 2.5 million customers are registered on Wealthsimple. The company, furthermore, employs close to 1,000 people across multiple offices.

How Does Wealthsimple Make Money?

Wealthsimple makes money via management fees, currency conversion fees, operations fees, additional services, interest on cash, as well as interchange fees.

The business model of Wealthsimple is predicated on becoming a so-called financial super app, which is heavily inspired by the likes of China-based Alipay or WeChat.

As a result, Wealthsimple unveiled a completely rebranded app back in June 2022. The redesign combined all of its products into one single application.

The biggest advantage of the super app approach is the ability to cross-sell customers into other services. For example, offering access to stocks when someone was initially only trying to purchase an ETF is often just one or two clicks away.

Over time, Wealthsimple could simply add to that ecosystem, which in turn keeps customers engaged for longer (again contributing to the ability to cross-sell).

And we don’t have to look too far beyond Canadian borders to see that this approach works. The Cash App, for example, has introduced ancillary products such as the option to get paid earlier or free tax filing.

Another key advantage is the data that those apps then generate. The platforms, by collecting information such as salaries or tax returns, can provide more sophisticated recommendations with regards to how much one should invest and where they should put their money.

So, without further ado, let’s take a closer look at each of Wealthsimple’s revenue streams in the section below.

Management Fees

When Wealthsimple launched back in September 2014, its bread and butter was made via the management fees it charges for its investment product.

For accounts with a balance below CA$100,000, which are part of the Basic plan, a management fee of 0.5 percent is applied. That fee is deducted from the user’s balance every month.

The Basic plan offers a variety of additional features, including auto-rebalancing and -deposits, the creation of a personalized portfolio, dividend reinvesting, and more.

Customers with deposits above CA$100,000 can opt into the Black plan. Here, the management fee is reduced to 0.4 percent while offering additional features such as dedicated financial planning sessions or tax-loss harvesting.

Lastly, high net worth individuals with funds above CA$500,000 can become customers of the Generation plan. Some of the additional features include a dedicated team of advisors as well as 50 percent of one’s Medcan health plan.

A variety of other online brokerages, such as Canadian competitor Questrade, have adopted similar management fee models.

Currency Conversion Fees

Another source of income for Wealthsimple is the currency conversion fees it charges whenever a Canadian user deals in a US-denominated asset.

The currency conversion fee is equal to 1.5 percent. It is applied whenever a user either purchases or sells an asset.

Unlike trading platforms like Robinhood or Webull, Wealthsimple does not generate revenue by selling order flow to hedge funds. This practice is forbidden in Canada by law.

Wealthsimple, furthermore, charges for additional services if a user prefers to not transact within the app. For example, a broker-assisted phone trade costs $45 while receiving a paper account statement is equal to $20.

For its Crypto product, Wealthsimple also applies a so-called operations fee that is between 1.5 to 2 percent (charged on both purchases and sales).

However, this fee is used to cover their custodial expenses which are charged by their third-party custodian Gemini.

Interest On Cash

In 2018, Wealthsimple introduced a high yield savings account that allows users to earn interest on the cash residing in those accounts.

Now, Wealthsimple doesn’t just hand out cash for free. Instead, it is able to pay its users interest fees because the firm itself generates interest from those deposits.

The money that is located in those accounts is primarily being deposited in interest-bearing bank accounts.

The interest that Wealthsimple receives is consequently higher than the one that customers are being pad. As such, Wealthsimple turns a profit on the delta between those two figures.

Interchange Fees

In August 2021, Wealthsimple introduced a physical debit card (called the Wealthsimple Cash card) in cooperation with Visa.

The card is linked to the user’s cash account and allows them to retrieve money from ATMs or pay at millions of merchants across the world.

Just like with any other debit or credit card, a so-called interchange fee is applied whenever you use it. This interchange fee, normally around one percent, is then paid by the merchant who receives the payment.

Visa, as the issuer of the debit card, and Wealthsimple then likely share the interchange revenue among each other. The actual revenue share is not made public.

Generating income through interchange fees and the launch of a debit or credit card is a common revenue source for many FinTech companies. Chime, for instance, derives the majority of its revenue from those fees.

Wealthsimple Funding, Revenue & Valuation

According to Crunchbase, Wealthsimple has raised a total of $900.4 million across nine rounds of venture capital funding.

Investors include Power Financial Corporation, Greylock, Redpoint, Two Sigma Ventures, Allianz, Sagard Capital, actor Ryan Reynolds, hip hop artist Drake, and many more.

Wealthsimple is currently valued at $4 billion after raising a ~ $610 million private equity round back in May 2021.

As a private company, Wealthsimple is not obligated to share revenue figures with the public. It will do so once it ever decides to go public as part of the filing process.

Who Owns Wealthsimple?

Wealthsimple is majority-owned by Power Financial Corporation, a wholly-owned subsidiary of Power Corporation of Canada, which is an international management holding company.

Power currently owns 43 percent of Wealthsimple. Furthermore, the company possesses 60 percent voting power.

The company was able to acquire such a large stake in Wealthsimple because it led most of its previous funding rounds. At one point, Power’s ownership stake was as high as 89 percent but the holding company has since sold off some of its existing shares.

Other major shareholders, although they don’t publicize their ownership, include Allianz X, Two Sigma Ventures, and Greylock (which all participated in multiple rounds).