Executive Summary:

Rakuten makes money from various internet service portals, personal finance solutions, mobile plans, venture investments, and much more.

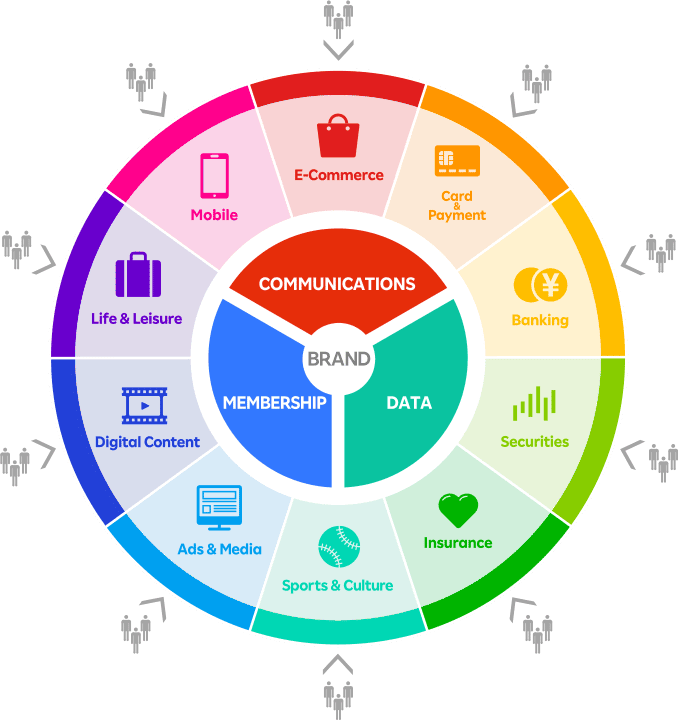

The business model of Rakuten is predicated on creating an ecosystem around the 70+ businesses it runs.

What Is Rakuten?

Rakuten, which stands for “optimism” in Japanese, is a technology conglomerate that serves users in 30 countries across the globe.

The Rakuten Group boasts 70+ businesses and 1.6 billion members worldwide. Its businesses span a broad range of online and offline services such as:

- E-commerce

- Travel

- Digital content

- FinTech including banking, credit cards, securities, and insurance

- Communications such as mobile carrier service or streaming

Most consumers in the United States, which the company entered in 2000, know Rakuten as a platform where one can earn cashback rewards.

That service alone works together with 3,5000 retailers and has facilitated close to $4 billion in cashback returned, on top of closing sponsorship deals with the likes of Steph Curry.

However, the firm’s core business remains situated in e-commerce via a Japan-based marketplace called Rakuten Ichiba. That platform alone counts over 111 million members, which is particularly impressive given that Japan’s population totals 126 million people.

Rakuten, much like its Japanese contemporary SoftBank, is also an investor in a variety of other companies including Acorns, Lyft, Pinterest, and many others.

The company, which is headquartered in Tokyo, Japan, was founded back in 1997 by Hiroshi Mikitani.

He was heavily inspired by the likes of Amazon and eBay when he started what was initially called MDM. Said firm was then rebranded into Rakuten two years after and taken public on the JASDAQ in 2000.

He has since expanded Rakuten’s focus from e-commerce to all kinds of associated businesses. The business model strategy behind that pivot will thus be covered in the next chapter.

The Rakuten Business Model Explained

As previously stated, Rakuten began life as an online marketplace that connected buyers with sellers.

However, competitive threats, namely the entry of both Amazon and eBay into Japan in the early 2000s, forced Mikitani to rethink Rakuten’s business model strategy.

By the mid-2000s, Rakuten began to a) expand outside of Japan and b) add ancillary business lines such as a company-branded credit card. The majority of said expansion was achieved in the form of acquisitions and joint ventures.

One of Rakuten’s most notable acquisitions to this date is its 2014 purchase of Ebates, which it bought for $1 billion. The acquisition solidified Rakuten’s cashback business in the United States and beyond. And just a few months prior, it had acquired messaging app Viber for roughly the same amount after missing out on WhatsApp, which had been bought out by Facebook.

All of those acquisitions and subsidiaries are now directly tied to Rakuten’s ecosystem-based business model.

Founder Mikitani first outlined that strategy in an interview with CNBC back in April 2018. “In the future, we’re going to see the conversion of network platforms and content and transactions,” he told CNBC’s Akiko Fujita. He then doubled down on that take by saying that “it’s all about ecosystem.”

At the core of that ecosystem approach stands the Rakuten brand, which is adapted by almost all of the company’s 70+ business lines.

Whether it’s Viki (streaming) or Kobo (books), Rakuten’s brand is always tied to any business that is launched. This creates substantially more trust from the get-go and allows Rakuten to generate demand almost instantaneously.

Those diverse, and at times not even related, services are then linked vis-à-vis a common membership and loyalty program. By accessing these offerings, whether that’s streaming content or booking a flight, members can earn Rakuten Points.

Each user is given a unique Rakuten member ID that is linked across all of its services. A similar approach has been championed by Amazon via its Prime program, which grants customers access to free deliveries as well as streaming or audio content, among many other benefits.

That ecosystem approach offers a few key distinct advantages. First, it significantly decreases Rakuten’s customer acquisition costs. Instead of having to promote a new service by purchasing expensive ads on Google, Facebook, or even TV, it can simply advertise it through its different business units.

For example, Rakuten heavily endorses its other services, namely its credit card, travel marketplace, wallet, and even mobile carrier, on the Ichiba marketplace.

Paying less to acquire customers consequently boosts the firm’s margins, which it can then invest into the launch or expansion of other business lines.

It has to be noted, though, that there’s at least some opportunity cost involved as Rakuten cannot generate revenue from (banner) advertising that this slot could potentially yield.

Conversely, the second major advantage of the ecosystem approach is that it maximizes the lifetime value of each customer. The reason why banking or insurance companies pay so much to acquire members is that they often remain loyal for years or even decades at a time.

Similarly, the more associated services Rakuten is able to offer, the likelier a customer is to stick around. And the longer he or she sticks around, the greater the chance of them opting into one of those offerings – again, at no cost to Rakuten since it acquired the customer for essentially free.

Additionally, the more users access Rakuten’s varying services, the more the company learns about their spending patterns, financial situations, and the like. This then enables Rakuten to show consumers more relevant ads from its own and third-party services.

For instance, if it sees that a customer is purchasing dog food, collars, and so forth, it can offer them insurance for their pet (a service that it launched in 2021). And again, members are incentivized to join because they’ll be earning rewards points.

In 2021 alone, Rakuten issued over 530 billion points, which is equal to about $4.6 billion. And customers used 90 percent of their points, which points towards high engagement as well as the relevance of the products and services that the company provides.

The data that Rakuten generates not only allows them to show more relevant ads but also helps the company to determine what business lines to enter. The launch of its pet insurance and membership programs was likely informed by purchasing behavior observed on its marketplace and via the credit card, among other channels.

Consequently, Rakuten can utilize the learnings from one business unit to apply them to another, especially considering that the technology stack across its various platforms should be fairly identical.

Yet another key benefit is the diversification that Rakuten achieved. For example, the Covid-19 pandemic eroded earnings from its travel product overnight. However, e-commerce simply picked up the slack as consumers shifted their buying behavior towards online shopping.

However, the ecosystem approach also boasts a few disadvantages. Currently, Rakuten is building up a whole new mobile division from scratch (more on that in the coming chapters), which means that the firm is incurring some heavy losses.

Investing in new divisions, whether they are set up by Rakuten itself or through joint ventures, naturally requires significant upfront investments. Those investments will normally take years to amortize, which can be particularly troubling if you’re a publicly-traded entity like Rakuten.

An additional disadvantage may be a lack of focus. If, for example, Rakuten’s e-commerce competitors decide to ramp up their spending, then the firm likely has to follow suit. It may, however, not have sufficient funds as it already committed that budget to a variety of other departments that may require investment.

Interestingly, Rakuten’s ecosystem now extends beyond online as well. For instance, the company has inked various partnerships with supermarkets such as Seiyu, thus enabling customers to earn points at other (physical) locations.

Now that we’ve dissected Rakuten’s business model strategy, let’s take a closer look at how the company actually makes money.

How Does Rakuten Make Money?

As outlined in the previous chapters, Rakuten is able to make money from a diverse set of businesses that include almost every relevant market.

The Rakuten Group currently breaks down its revenue into three distinct segments, namely Internet Services, FinTech, and Mobile.

While I won’t go into detail about every single revenue stream that Rakuten has (we are both not ready for 20,000 words of content, trust me), I will nonetheless try to highlight the firm’s most significant ones.

So, without further ado, let’s take a closer look at each of Rakuten’s revenue streams.

Internet Services

Internet Services represent Rakuten’s largest income source and, as the name suggests, are comprised of all of the firm’s internet-based offerings.

Rakuten Ichiba, its Japan-based e-commerce marketplace, drives most of that revenue. Over 56,000 merchants have so far set up shop on the platform and collectively facilitate daily sales of close to $100 million.

The majority of revenue that Rakuten derives from its marketplace comes in the form of commissions. Sellers, depending on the category, pay anywhere between 2 percent to 4 percent for every item sold.

Additionally, Rakuten charges registration and listing fees, payment processing fees, fixed monthly consultation fees, affiliates fees, system enhancement fees, and fees for users that earn points. The platform’s detailed fee structure can be accessed here.

Alternatively, sellers on the platform can promote their products, too. For example, they can purchase ad slots based on the queries that customers search for. Rakuten then makes money from every click that those ads attract.

The company offers a fulfillment service for its merchants (called Rakuten Super Logistics), for which it obviously charges a fee, as well.

Rakuten Ichiba is certainly not the only e-commerce play that the company is pursuing. In October 2018, Rakuten and Japanese supermarket chain Seiyu announced a collaboration that culminated in the launch of Rakuten Seiyu Netsuper, an online grocery delivery service jointly operated by both companies.

The two firms generate revenue from that service just like any other supermarket: by selling items for more than they were initially purchased for, on top of associated costs such as storage or delivery.

Again, Rakuten has utilized its ecosystem play to boost adoption. Customers paying with the Rakuten Card can earn up to 1.5 percent in cashback rewards.

Furthermore, the collaboration informed the launch of Rakuten Zenkoku Super, a system for operating online supermarkets that entails order management and online payment systems, among others.

Other e-commerce units of Rakuten are Rakuten Fashion, Rakuten Books, Rakuten Rakuma (a C2C marketplace app where users can purchase unneeded items from other users), and Rakuten Bic (daily necessities sales service).

Yet another huge revenue driver for Rakuten is its travel offering. Much like Booking or Expedia, it allows travel operators to list their flights, trains, and accommodations on the platform. And again, it receives a commission for every sale, on top of offering banner and search advertising.

Interestingly, Rakuten has split up its travel business into distinct platforms instead of a single one. On Rakuten Travel Experiences, users can book tours and activities. Rakuten Stay solely lists vacation rentals while Rakuten CarShare enables customers to rent vehicles.

On the other side of the globe, American consumers know Rakuten as a cashback program where they can earn rewards for shopping at selected merchants. Here, Rakuten operates under an affiliate business model, meaning it receives a commission every time customers shop at one of its partners.

The third broad category within its Internet Services division is the various media businesses it operates.

We previously mentioned Rakuten Viki, which is one of the world’s most popular video-on-demand services. Much like Netflix, Viki generates income from subscription fees as well as advertising. Users can also simply watch movies on Rakuten TV. Other media assets are Rakuten Music and NBA Rakuten.

The last category could be defined as essential internet services. Users can purchase tickets to events (Rakuten Ticket), browse the internet (Rakuten Infoseek), search and post recipes (Rakuten Recipe), and even purchase and sell NFTs via Rakuten NFT.

Again, the group generates revenue through a variety of different means. NFTs sold via the online marketplace are subject to commission fees while the search engine monetizes queries via keyword-based advertising.

Since you’re a smart reader you’ve probably already guessed that the ecosystem approach comes into play once again. For example, when searching to purchase concert tickets on Infoseek, Rakuten is showing results of its own ticketing service on top.

A similar strategy has been adopted by search giant Google as well. When searching for queries like ‘flights’, Google regularly features its own flight comparison tool on top. Competitors would then need to invest in search ads, which allows Google to generate additional revenue and weaken its competition even further.

All of those internet services are supported by the firm’s financial division, meaning customers can utilize Rakuten-owned payment services to pay for the goods and services they order. So, let’s cover that division, shall we?

FinTech

The Rakuten FinTech Group oversees the firm’s financial division. The group is acting as an ecosystem in and of itself as well as a key pillar of Rakuten’s overall ecosystem business model strategy.

Let’s first highlight what types of financial businesses Rakuten operates. The most relevant are:

- Rakuten Bank: a fully licensed and internet-based bank that offers consumers access to savings accounts and more

- Rakuten Card: a credit card issued by Rakuten Bank

- Rakuten Edy: a prepaid type of e-money that can be used at over 400,000 member stores

- Rakuten Insurance: offering general, life, and pet insurance

- Rakuten Pay: a digital payments app that enables users to make purchases online and in physical stores

- Rakuten Securities: an online brokerage that enables users to purchase and sell shares, ETFs, and other financial instruments

- Rakuten Wallet: a crypto asset exchange service that allows users to trade digital currencies like Bitcoin

As you might have guessed, those financial products fuel consumption across Rakuten’s various internet services. Every time members use the Rakuten Card, Edy, or Pay, they are eligible to earn cashback and other types of rewards.

This poses various advantages for Rakuten as well. First and foremost, Rakuten is saving costs with regard to payment processing. Conversely, the firm generates revenue from the interchange fees that its credit card yields (whenever a member uses the card to pay for goods and services).

It also gains access to the consumer’s spending patterns and financial situation – information it can use to recommend more tailored products.

Lastly, it also offers a vastly better user experience. Members can, for example, use their Rakuten Card (or even their points) to pay for stocks or ETFs they purchase on Rakuten Securities. No lengthy registration process is required hereby.

The ecosystem approach has enabled Rakuten Securities to become the leading service of its kind in Japan. Furthermore, Rakuten Bank is also the largest online bank in the nation.

Revenue is being generated through a variety of different means. Securities and Wallet derive the majority of their income from the trading fees that customers pay whenever they purchase or sell a financial asset.

Many of its payment products, such as the credit card or payment app, impose fees on merchants who accept those payments. The various insurance products simply collect monthly premiums. ATM or late fees are certainly part of the revenue mix as well.

And since Rakuten Bank is a fully licensed bank, it can use member funds and deposit them in interest-bearing bank accounts. Issuing loans is another possibility.

Interestingly, some of those businesses are operated abroad, too. While the Rakuten Card is available within the Americas, customers from Europe can open a bank account. However, the ecosystem benefits don’t really come into play here.

The last revenue generator is the corporate venture capital group Rakuten Capital. There, the firm either incubates new businesses or invests in promising startups.

According to Crunchbase, Rakuten has made over 70 venture investments thus far. One of its biggest wins became the ride-hailing platform Lyft. Rakuten had invested $700 million for a 13 percent stake, which netted the firm $2 billion when Lyft went public back in March 2019.

Although this investment has since turned a little sour, which led Hiroshi Mikitani to step down from Lyft’s board in September 2020, there were still plenty of winners. Rakuten makes money from the division whenever it sells the shares it initially purchases for a higher sum.

However, there are other key benefits, too. For once, it can potentially partner with the firms it invests in, thus creating additional demand for their products and services, which makes a positive return on investment much likelier.

Second, as an investor, it is entitled to sensitive data such as revenue, user numbers, profit metrics, and so forth. It can then utilize this data to inform its own product launches. For example, in Germany it is invested in simplesurance, a deal that certainly helped with the launch of its own insurance products.

While both internet services and FinTech remain core pillars of its revenue mix, there is one recently-launched business unit that might eventually trump them all.

Mobile

In April 2020, the company launched its long-anticipated low-cost data plan Rakuten Mobile. Priced at 2,980 yen (about $27) per month, the plan granted consumers access to unlimited calls and data where Rakuten has its own networks.

A mere 5 months later, it launched a 5G service for the same price as its existing 4G plan. Rakuten, in order to get that service off the ground, enlisted a heavy-hitter roster of vendors including Nokia Intel, Red Hat, Cisco, and dozens more.

They helped the company to implement what Rakuten deemed to be “the world’s first end-to-end fully virtualized, cloud-native mobile network.”

From the radio access network (RAN) to the core, each component of the service could be operated using software instead of hardware that’s complex to upgrade. This also means that all of those components could be operated from the cloud.

Rakuten already had some prior experience in the industry as it ran a successful mobile virtual network operator (MVNO) business. However, its plans to become an end-to-end carrier are certainly more ambitious and costlier.

But why did it embark on that path? Because being a mobile operator can be an extremely profitable business that’s printing cash. Just ask the likes of NTT DoCoMo, KDDI, and SoftBank who were leading the charge in Japan for decades.

And what did all of them have in common? They were charging triple what Rakuten Mobile does. Rakuten was able to undercut them on price because its virtualized network is substantially cheaper to operate. Prime Minister Yoshihide Suga even attacked the operators for the prices they were imposing on customers.

Nevertheless, implementing your own network doesn’t come cheap. Rakuten said that it would take $5.4 billion to build its 4G network and another $1.8 billion to update to 5G.

Being a mobile operator can be extremely lucrative since customers tend to churn less frequently. And once again, the ecosystem approach comes into play here. Primarily, the mobile offering acts as yet another entry point to acquire new customers.

And those customers also seem to be more engaged. In one of its earnings releases, the company stated that Rakuten Mobile subscribers spend 35,831 yen (~ $260) more on Ichiba than non-subscribers.

Interestingly, Rakuten has also adopted one of Amazon’s key strategies, which is to turn cost centers into money makers. In August 2021, it announced the launch of Rakuten Symphony, a service through which it helps other telco companies to set up virtualized networks.

Going forward, Symphony will also introduce cloud storage, a digital app marketplace, customer relationship management tools, and much more. All of those products will then be sold as white-label offerings.

Right now, the unit continues to rack up heavy losses but is expected to amortize the initially invested capital over the next 5 years.

P.S.: since I didn’t know where else to put it. Rakuten also owns two sports teams, namely the football club Vissel Kobe and the baseball team Tohoku Rakuten Golden Eagles. And yes, the firm generates revenue from those clubs as well, for instance via ticket sales, transfer fees, TV rights, and merchandising.

Does Rakuten Sell Your Information?

No, Rakuten does not sell personally identifiable information despite the tropes of data it generates about its users.

The company does specify what type of data it collects within its help center. It includes personal information about you as a person (e.g., age or gender), location, search history, payment methods, connected accounts, referral history, and so forth.

Rakuten primarily utilizes this information to inform what products and services – whether that’s their own or third-party offerings – it recommends.

However, Rakuten may also sell aggregated sales and marketing data to other companies for a one-time fee.

For example, if a fashion brand thinks about designing a certain type of shoe, it may purchase sales data from Rakuten’s marketplace to see how often that product has been searched for or even bought, what the average price of said product is, and how the customer demographic looks like (e.g., gender split, where customers are based, etc.).

Once again, that data would not include any information that makes customers identifiable to protect their privacy.

How Much Revenue Does Rakuten Generate?

Rakuten’s ecosystem approach has propelled the company into one of Japan’s leading digital platforms.

Moreover, it has also allowed its founder Hiroshi Mikitani to become one of Asia’s richest people as he continues to hold a double-digit percentage stake in Rakuten.

Below is an overview of how much revenue and profit (= net income) Rakuten has been able to derive over the past couple of years:

| Year | Revenue | Net Income (after tax) |

| 2017 | 944.5 billion yen | 110.5 billion yen |

| 2018 | 1.11 trillion yen | 141.9 billion yen |

| 2019 | 1.26 trillion yen | (33.1 billion yen) |

| 2020 | 1.46 trillion yen | (115.8 billion yen) |

| 2021 | 1.68 trillion yen | (135.8 billion yen) |

As you can see, Rakuten has incurred some heavy losses over the past few years. This is largely coming from the investments it made in its mobile division, namely in building up the network and acquiring companies in the space.

However, with over $60 billion in cash on hand, the company can certainly afford to pursue its loss-making strategy for a few more years.

Additionally, it plans to take some of its other business units, such as the securities division, public, thus adding even more cash to its rapidly depleting balance sheet.