Executive Summary:

Gemini is a FinTech company that allows users to purchase, store, and sell a variety of cryptocurrencies.

Gemini makes money via transaction fees, transfer fees, interchange fees, interest on cash held in its Earn accounts, as well as custody fees.

Founded in 2014, Gemini has grown to become one of the biggest cryptocurrency exchanges on the globe. It is now valued at $7.1 billion.

What Is Gemini?

Gemini is a FinTech company that allows users to purchase, store, and sell a variety of cryptocurrencies.

At the core of its offering stands its centralized exchange within which users can trade over 60 different tokens.

Apart from its exchange, users can also utilize their coin holdings to earn up to 8 percent in annual percentage yield (APY).

Furthermore, one can also earn crypto rewards on every purchase they make by using a Gemini-branded credit card. Users can earn up to 3 percent in cashback rewards.

Almost all of Gemini’s products are powered by its very own token dubbed the Gemini dollar (GUSD), a stablecoin that is pegged to the US Dollar.

For its most affluent customers, namely other businesses, Gemini also offers a secure custodian solution that allows them to store greater holding amounts.

If you’re new to the world of blockchains and cryptocurrencies, then Gemini also offers a slew of educational material vis-à-vis its Cryptopedia platform.

The Gemini platform can be accessed by visiting the company’s website or by downloading any of its mobile apps (available on Android and iOS devices).

How Gemini Started: Company History

Gemini, which is headquartered in New York City, was founded in 2014 by identical twin brothers Cameron and Tyler Winklevoss.

The twins’ claim to fame arose from their portrayal in the 2010 hit movie The Social Network, which detailed the early days of Facebook.

They claimed that Facebook founder Mark Zuckerberg, who they initially hired to build a social network called Connect.U.com, had stolen their idea to launch his own business.

All involved parties eventually settled in February 2008, netting the Winklevii, as they are widely known, $65 million in settlement money (of which $20 million were paid in cash and the rest in Facebook stock, which further appreciated in the years that came).

In the meantime, the twins used that money to pursue private endeavors by first participating in the 2008 Beijing Olympics (where they managed to place 6th for the USRowing team) and then following that up with an MBA at Oxford.

After an additional windfall from Facebook’s IPO in April 2012, which catapulted their holdings to over $300 million, they decided to put their cash to work by investing in tech startups.

Unfortunately, at the time, many startups in the Valley hoped to eventually sell their business to Facebook, which discouraged founders from taking the Winklevii’s money.

However, their fortunes would soon change for the better. In June 2012, the twins were introduced to Bitcoin for the first time while being on vacation in Ibiza.

A few months later, they used about $11 million of their own cash to purchase Bitcoin, which at the time was valued at around $9. Effectively, they managed to scoop up one percent of all the circulating supply.

Moreover, their public embracement of the digital currency allowed them to become advocates for the space as a whole – and invest in blockchain-related startups in the process.

Unfortunately, not all of these investments turned out to go as planned. In May 2013, they put $1.5 million into a Brooklyn-based exchange dubbed BitInstant.

The platform allowed people to exchange dollars for Bitcoin in exchange for a fee. At some point, BitInstant was accounting for more than 30 percent of all Bitcoin purchases.

Not all of these purchases were kosher, though. Many people used the platform to launder money for drug dealers that were selling illegal items on the dark web. By the end of 2013, BitInstant was shut down and its founder Charlie Shrem sentenced to one year in prison.

Around the same time, the then-largest exchange Mt. Gox filed for bankruptcy after a series of hacks led to the loss of more than 850,000 bitcoins.

Being deeply convinced that Bitcoin (and cryptocurrencies at large) were the future of money, they eventually decided to venture out on their own again. However, in order for that vision to materialize, they also believed that businesses couldn’t act independently of a regulatory environment.

In January 2015, after some preliminary conversations with regulators, the Winklevii announced their intention to launch Gemini, which translates to ‘twin’ in Latin, later that year. Seven months later, in July, they applied for a limited liability trust company in New York, which they were finally granted in October.

That same month, they finally unveiled their exchange. Users would be able to purchase and sell bitcoin only. Despite an aggressive marketing campaign, which saw Gemini being featured in publications such as The Financial Times, TechCrunch, and Wired, as well as on TV (Fox News), adoption of the platform was pretty underwhelming.

One of the biggest points of criticism was the exchange’s decision to charge a fee to both makers and takers. Conversely, competing platforms like Coinbase, Coinfloor, Kraken, and itBit solely imposed fees on takers.

Four months after the launch, in February 2016, the leadership team decided to adjust its fee structure, which did end up attracting more users to the platform. In May, the platform received regulatory approval to offer trading for Ether, the native token of the Ethereum network.

The year was capped off launching in both Japan and South Korea, its first two foreign markets. Throughout 2017, the platform benefitted from an unprecedented crypto bull run that sent the price of Bitcoin all the way to $20,000 (up from a little over $1,000 at the beginning of the year).

Bitcoin’s ascent (and the twins’ deep pockets) also allowed the company to make some impressive hires. In July 2018, Gemini hired Robert Cornish, former New York Stock Exchange (NYSE) chief information officer, as its first CTO. That same month, it also added Zcash, its third tradeable coin.

A mere two months later, it introduced its very own coin dubbed GUSD, which is pegged to the United States Dollar. By the end of 2018, it offered a total of six tradeable coins on its platform while also having launched its first-ever mobile apps for Android and iOS devices.

Gemini also continued to double down on its regulatory- and security-first mantra. At the beginning of 2019, it launched a new ad campaign calling for better regulation of the crypto space (stating “crypto needs rules”).

It also became the world’s first centralized exchange that successfully completed the System and Organization Controls (SOC) 2 Type 1 examination. The focus on security also trickled down to its own GUSD token, which was listed on more and more platforms (such as BlockFi in May).

It continued the year with a launch in Australia (August), an institutional-grade crypto custody solution (September), and by making its first-ever acquisition. In November, it purchased Nifty Gateway, an NFT marketplace founded by twins Duncan and Griffin Cock Foster.

The next year, which was characterized by heightened trading activity as a result of the coronavirus pandemic, saw Gemini focus even more on expanding into new markets. In October 2020, for instance, it received regulatory approval in the United Kingdom.

It also announced a variety of partnerships with other businesses, such as an integration with the Brave browser, TaxBit, or Samsung’s Blockchain Wallet, amongst others.

A very successful 2020 allowed Gemini to also remain on the offensive. In January 2021, it announced its second acquisition with the purchase of Blockrize, which eventually led to the launch of its very own credit card.

Just a month after, it also launched its own savings account dubbed Earn as well as Cryptopedia, an educational platform for crypto beginners. By May, the exchange had more than $30 billion in crypto under custody.

In the meantime, the Winklevoss twins also continued to serve as public spokesmen for the company and crypto community. They were often extremely strategic in their messaging to appease government officials and the wider public.

One example was the launch of Gemini Green, a long-term initiative to help adopt climate-conscious behavior in the company. The Winklevoss twins also remained outspoken against competing platforms like Binance which they accused of circumventing government regulations.

That outspokenness and continuous product expansion earned the company its first round of venture funding. In November, Gemini raised a whopping $400 million in a round that valued the business at $7.1 billion.

How Does Gemini Make Money?

Gemini makes money via transaction fees, transfer fees, interchange fees, interest on cash held in its Earn accounts, as well as custody fees.

Let’s take a closer look at each of its revenue streams in the section below.

Transaction Fees

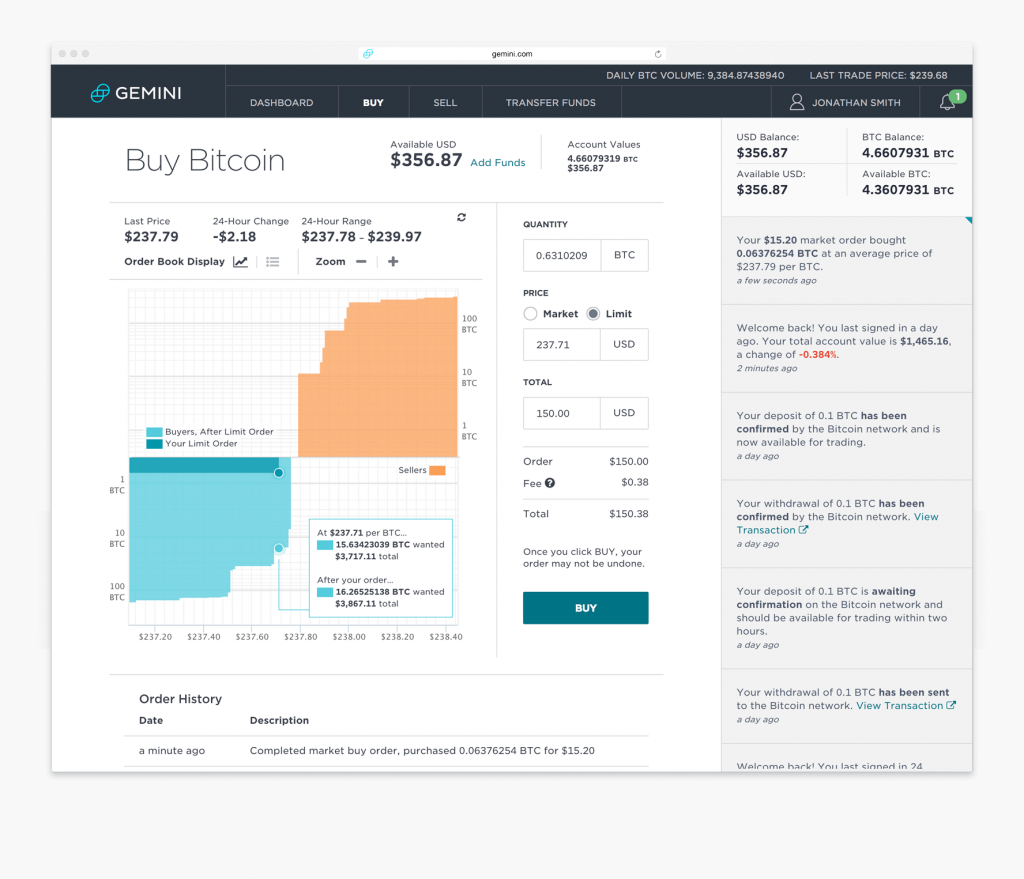

The vast majority of the revenue that Gemini generates comes from the transaction fees it charges for trades placed on its platform.

For orders placed via its mobile app as well as the website, it imposes a transaction fee that is dependent on the order amount.

For instance, an order below $10 will cost users $0.99 while anything above $200 costs 1.49 percent of the order volume.

Apart from its mobile and web platform, Gemini has also built tools for sophisticated traders. These are dubbed ActiveTrader, a high-performance crypto trading platform that delivers a professional-level experience. On top of that, users can plug into an API that allows them to programmatically execute traders.

Gemini utilizes a maker-taker fee model for determining trading fees for all orders placed via the API and its ActiveTrader platform.

This essentially means the trader pays a different fee that is contingent on whether his/her order generates liquidity because there is no matching order (= you are a maker) or the order decreases liquidity since it matches with an order already on the books (= you are a taker).

As a result, traders normally pay higher fees when they are the taker. Gemini imposes a variable fee structure. This means that fees decrease the more trades a user places on the platform over the course of 30 days.

Transfer Fees

Whenever users want to deposit and withdraw money into their Gemini accounts, the company charges them with a deposit and withdrawal fee, respectively.

Deposit fees are only paid for debit card transfers and are equal to 3.49 percent. Deposits from ACH and wire transfers are free of charge.

Meanwhile, withdrawal fees are charged whenever customers intend to withdraw more than 10 tokens per month.

The withdrawal fee is dependent on the type of customer (individual vs. institutional) as well as what token is withdrawn.

For example, if an individual customer intends to withdraw over 10 Bitcoin, then Gemini charges 0.001 BTC for that transaction.

Interchange Fees

In 2021, Gemini announced and launched its own credit card in cooperation with MasterCard, allowing users to spend their cash balances in the real world.

The card grants holders a variety of benefits such as up to 3 percent in cashback rewards (which can be paid out in 40+ currencies), no annual fees, 24/7 customer support, and many more.

Prior to the launch, Gemini had acqui-hired FinTech startup Blockrize, which began working on a similar product to accelerate the launch.

Just like any other credit card, Gemini generates revenue through interchange fees. These fees, which are normally around 1 percent, are paid by the merchant.

Gemini then shares that revenue with MasterCard, which issues the physical card and provides the underlying payment technology.

These days, many cryptocurrency exchanges, for example, Binance or FTX, utilize debit and credit cards as a means of generating additional revenue.

Customers are already comfortable with storing their money on the exchange. Offering them additional incentives, such as cashback rewards, further incentivizes them to remain loyal customers.

Interest On Cash

Alongside its credit card product, Gemini also announced the launch of a high yield savings account called Earn.

Users can lend out their cryptocurrency holdings to the platform and earn up to 8 APY (rates may vary, though).

Now Gemini does not just hand out free cash from the goodness of their heart. Instead, it actually lends out that crypto, through the help of its lending partner Genesis Global Capital, to institutional borrowers who pay interest on those loans.

Gemini and Genesis Global Capital then pocket the difference between the interest paid by those institutional borrowers and the one it pays out to customers (it refers to this as agent fees).

It then conducts periodic check-ups on its partners’ cash flow, balance sheet, and financial statements to ensure the appropriate risk ratios.

With Earn, Gemini competes against other crypto lenders such as the previously-mentioned BlockFi, Ledn, Nexo, Coinloan, and many others.

Custody Fees

Gemini offers a custody solution for its most sophisticated clientele. The company is a qualified custodian under New York Banking Law and is licensed by the State of New York to custody digital assets.

Gemini Custody itself is brokered and managed by Marsh and Aon. The company, furthermore, provides $200 million in cold storage insurance coverage, which it claims is the largest limit of insurance coverage purchased by any crypto custodian in the world.

Clients can store over 50 different tokens, including Bitcoin, Ethereum, Loopring, Uniswap, and many others.

In exchange for that service, Gemini charges a custody fee of 0.4 percent. The fee itself is annualized and deducted in the respective digital asset held in the custody account.

Gemini Funding, Revenue & Valuation

Gemini, according to Crunchbase, has raised a total of $400 million in just one round of venture capital funding.

Noteworthy investors include Boost VC, Newflow Partners, K5 Global, Jane Street Capital, and many others.

The exchange was valued at $7.1 billion when it raised the above-mentioned $400 million back in November 2021.

As a company in private ownership, Gemini is not obligated to disclose revenue figures to the public. It may do so during a future funding announcement or in the case of an IPO.

Who Owns Gemini?

Cameron and Tyler Winklevoss remain the majority owners of Gemini, which they started and funded throughout most of the firm’s existence.

This was made possible through their settlement with Facebook founder Mark Zuckerberg as well as an early investment in Bitcoin. The Winklevii’s are considered to be billionaires.

Their ownership stake was diluted by about 25 percent after announcing the $400 million fundraise in November 2021.